Gaussian mixture model (GMM) is a probability model for a mixture of several Gaussian distributions with possibly different mean and variance.

For example, we can model the 100m race time of all grade 12 students in a high school as two normal distributions: one for female students and one for male students. It is reasonable to expect two groups have different mean and may different variance.

When to use Gaussian mixture model?

1. Data has more than one clusters.

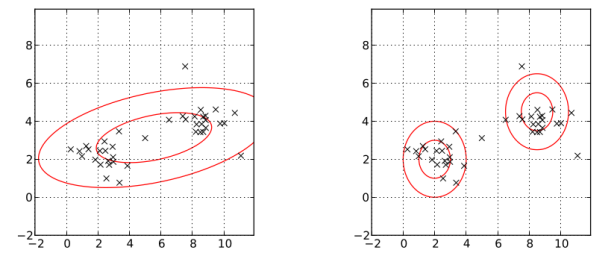

In the following picture, the left one models the data with one normal distribution; the right one models the data by two normal distribution, Gaussian mixture model. Obviously, the right one better describes the data.

2. Each cluster is theoretically normally distributed.

Theory of Gaussian Mixture Model

1. Gaussian distribution in 1 dimension

Since there are several Gaussian distributions in the GMM. We assign an index to each Gaussian distribution: ![]() for

for ![]() where K is the number of clusters. For a given mean

where K is the number of clusters. For a given mean ![]() and variance

and variance ![]() , the probability density function is

, the probability density function is

![]()

Above

2. Gaussian mixture model in 1 dimension

The probability density function of GMM is the weighted average of several Gaussian densities:

![Rendered by QuickLaTeX.com \[p(x|\mu_k,\sigma_k, k=1,2,...,K) = \sum_{k=1}^K w_k \cdot p_k(x|\mu_k,\sigma_k ),\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-43a9821781ab30977d08dc18bed86dcd_l3.png)

where

![Rendered by QuickLaTeX.com \[\sum_{k=1}^K w_k = 1\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-1cbe2e8d5a2ce1f1fcaef3e32fe7c455_l3.png)

Plug in the Gaussian density,

![Rendered by QuickLaTeX.com \[p(x) = \sum_{k=1}^K w_k \frac{1}{\sigma_k\sqrt{2\pi}}exp\left(-\frac{(x-\mu_k)^2}{2\sigma_k^2}\right)\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-a657f7bc6c42e9486be0ba6c7a0cf787_l3.png)

Note that this is a density function because its integral on ![]() is 1.

is 1.

3. Gaussian mixture model in n-dimension

Let ![]() be an n-dimension multivariate Gaussian random variable with mean vector

be an n-dimension multivariate Gaussian random variable with mean vector![]() and covariance matrix

and covariance matrix ![]() . Then the probability density function is

. Then the probability density function is

![]()

Then, the probability density function of GMM, which is the weighted average of serveral multivariate Gaussian density, is

![Rendered by QuickLaTeX.com \[p(x) = \sum_{k=1}^K w_k \frac{1}{\sqrt{(2\pi)^K|\Sigma_k|}}exp\left(-\frac{1}{2}(x-\mathbf{\mu}_k)^T\Sigma_k^{-1}(x-\mathbf{\mu}_k )\right)\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-cc5be764062ddb791b6882bc4e93a1f4_l3.png)

with

![Rendered by QuickLaTeX.com \[\sum_{k=1}^K w_k = 1\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-1cbe2e8d5a2ce1f1fcaef3e32fe7c455_l3.png)

Training the Model

Suppose that we know the number of clusters ![]() a priori. (The choice of

a priori. (The choice of ![]() relies on statistician’s experience.) Then, we can use Expectation Maximization (EM) algorithm to find the parameters

relies on statistician’s experience.) Then, we can use Expectation Maximization (EM) algorithm to find the parameters ![]() and

and ![]() or

or ![]() for multi-dimensional model. Let

for multi-dimensional model. Let ![]() be the number of clusters, and

be the number of clusters, and ![]() be the number of samples.

be the number of samples.

Step 1: Initialize

- Randomly choose

samples and set them to be the group mean. For example, in the case of

samples and set them to be the group mean. For example, in the case of  ,

,  ,

,  . (note that this is also valid for multi-dimensional case)

. (note that this is also valid for multi-dimensional case) - Set all variances (resp. covariance matrices) to be the same value: sample variance (resp. sample covariance matrix). Namely,

where![Rendered by QuickLaTeX.com \[\hat{\sigma_k}^2 = \frac{1}{N}\sum_i^N(x_i-\bar{x})^2,\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-19025e84c2b88d0c995e301952199ca8_l3.png)

.

. - Set all weights equal to

, i.e.,

, i.e., ![Rendered by QuickLaTeX.com \[\hat{w_k} = \frac{1}{K}.\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-0127cfd21c1f27c80c7e60c4e36edbb1_l3.png)

Step 2: Expectation

We compute the probability that a sample ![]() belongs to cluster

belongs to cluster ![]() .

.

![Rendered by QuickLaTeX.com \[\begin{aligned} \gamma_{nk} = &~ \mathbf{P}(x_n \in C_k|x_n, \hat{w_k}, \hat{\mu_k},\hat{\sigma_k} ) \\ = &~ \frac{\hat{w_k}p_k(x_n|\hat{\mu_k},\hat{\sigma_k})}{\sum_{j=1}^K \hat{w_j}p_j(x_n|\hat{\mu_j},\hat{\sigma_j}) } \end{aligned} \]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-9061aaabea11b55f164405f44bb9f7fa_l3.png)

Step 3: Maximization

Update parameters then go back to step 2 until converge

![Rendered by QuickLaTeX.com \[\hat{w_k} = \frac{\sum_{n=1}^N\gamma_{nk}}{N}\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-2029d49cb4111873a88ee29459bdb4fa_l3.png)

![Rendered by QuickLaTeX.com \[\hat{\mu_k} = \frac{\sum_{n=1}^N\gamma_{nk}x_i}{ \sum_{n=1}^N\gamma_{nk} }\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-e919444d875e3723786da4b77f4bbd6c_l3.png)

resp.![Rendered by QuickLaTeX.com \[\hat{\sigma_k} = \frac{\sum_{n=1}^N\gamma_{nk}(x_n-\hat{\mu_k} )^2}{ \sum_{n=1}^N\gamma_{nk} }\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-d67e2738e34303acd3a6c5572cecf3fd_l3.png)

![Rendered by QuickLaTeX.com \[\hat{\Sigma_k} = \frac{\sum_{n=1}^N\gamma_{nk}(x_n-\hat{\mu_k} )(x_n-\hat{\mu_k} )^T }{ \sum_{n=1}^N\gamma_{nk} }\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-5e899bee111b8a4c25f9e0629a6aacec_l3.png)

![Rendered by QuickLaTeX.com \[\begin{aligned} &~ C_A - P_A \\ = &~ C_E - P_E + P_E - P_A \\ = &~ S_0 - K e^{-rT} + P_E - P_A \\ \leq &~ S_0 - Ke^{-rT}\end{aligned}\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-fe1a798b995e50876a2ad42b955381b4_l3.png)

![Rendered by QuickLaTeX.com \[\begin{aligned} &~ \mathbb{E}[e^{-rT}(A_T-K)^+] \\= &~ \mathbb{E}[e^{-rT}(\frac{1}{T}\int_0^T S_u \textnormal{d} u -K)^+] \\\leq & ~ \mathbb{E}[e^{-rT}\frac{1}{T}\int_0^T (S_u-K)^+ \textnormal{d} u] \\= &~ \frac{1}{T}\int_0^T \mathbb{E}[e^{-rT} (S_u-K)^+ ] \textnormal{d} u \\\leq &~ \frac{1}{T}\int_0^T \mathbb{E}[e^{-ru} (S_u-K)^+ ] \textnormal{d} u \\\leq &~ \frac{1}{T}\int_0^T \mathbb{E}[e^{-rT} (S_T-K)^+ ] \textnormal{d} u \\ = &~ \mathbb{E}[e^{-rT} (S_T-K)^+ ] \\ \end{aligned}\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-5cf23b380e772edddabfc8ff197e5364_l3.png)