The quoting convention of the swaption volatility is annualized normal vol under annuity measure. Here, normal is contrary to log-normal. It is also called Black’s (vs Balck-Scholes) or Bachelier’s model. We will use formulas to explain what it means.

Note 1: Black’s model is used for quoting only in modern financial modeling. It doesn’t mean the dynamics of interest rates are modeled this way. A commonly used model for swaption is SABR (stochastic alpha beta rho).

Note 2: The formula below ignores nuances of the effective date, settlement date, and day count convention.

Notations:

![]() : maturity of swaption

: maturity of swaption

![]() : tenor (maturity) of the underlying swap

: tenor (maturity) of the underlying swap

![]() : risk neutral measure

: risk neutral measure

![]() : annuity or annuity measure where annuity matches the floating leg pay frequency of the underlying swap

: annuity or annuity measure where annuity matches the floating leg pay frequency of the underlying swap

![]() : strike

: strike

![]() : discount factor from

: discount factor from ![]() to

to ![]()

![]() : par swap rate for a swap contract from

: par swap rate for a swap contract from ![]() to

to ![]() seen at

seen at ![]() . We define a short-hand

. We define a short-hand ![]() when there is no confusion.

when there is no confusion.

![]() : conditional expectation on

: conditional expectation on ![]() for filtration

for filtration ![]()

![]() : present value of something.

: present value of something.

![]() : value of something at time

: value of something at time ![]() .

.

Below, we set up the formula for PV of a payer swaption assuming the notional is $1. For a more general notional, just scale the formula up by the notional. In a payer swaption, the purchaser has the right but not the obligation to enter into a swap contract where they become the fixed-rate payer and the floating-rate receiver.

![Rendered by QuickLaTeX.com \[\small \begin{aligned} PV_{\mbox{payer}} =& \mathbb{E}_0^{\mathbb{Q}}\left[\left(V_{\mbox{float}}(\hat{T})-V_{\mbox{fixed}}(\hat{T})\right)^+P(0,\hat{T})\right] \\ =& \mathbb{E}_0^{\mathbb{Q}}\left[ \left(S_{\hat{T}}(\hat{T},\hat{T}+\Delta)A(\hat{T})-KA(\hat{T})\right)^+P(0,\hat{T})\right] \\ = & A(0) \mathbb{E}^{A}_{0} \left[\left(S_{\hat{T}}(\hat{T},\hat{T}+\Delta) - K\right)^+\right] \end{aligned}\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-46b8968ad668b901d385cf47984bfdcb_l3.png)

The last line of the above formula is a change of numeraire from risk-neutral measure to annuity measure.

Since swaption vol is quoted as Bachelier’s vol in annuity measure, the dynamic of interest rate under this measure is the following:

![]()

where ![]() is a standard Brownian motion under annuity measure and

is a standard Brownian motion under annuity measure and ![]() is constant.

is constant.

Hence (by integrating both sides from ![]() to

to ![]() ), denoting by

), denoting by ![]() a normal distribution, we have

a normal distribution, we have

![]()

After plugging in the Gaussian density, the annuity measure expectation becomes

![Rendered by QuickLaTeX.com \[\small \begin{aligned} & \mathbb{E}^{A}_{0} \left[\left(S_{\hat{T}} - K\right)^+\right] \\ = & \int_{K}^{+\infty} (x-K) \frac{1}{\sigma \sqrt{2\pi\hat{T}}} e^{-\frac{(x-S_0)^2}{2\sigma^2\hat{T}}} \textrm{d} x \\ = & \sigma \sqrt{\hat{T}} \cdot \varphi (d_1) + (S_0 - K) \cdot \Phi(d_1) \end{aligned} ,\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-eb1476fe039617fd4d4d8a91e72ba15f_l3.png)

where

![]() is the probability density function of the standard Gaussian distribution

is the probability density function of the standard Gaussian distribution

![]() is the cumulative density function of the standard Gaussian distribution

is the cumulative density function of the standard Gaussian distribution

![]()

Finally,

![]()

The Greeks are as follows:

Delta = ![]()

Vega = ![]()

Gamma = ![]()

The vega-gamma relationship is:

![]()

The value of annuity ![]() depends on discounting curve, but one can approximate it by tenor (

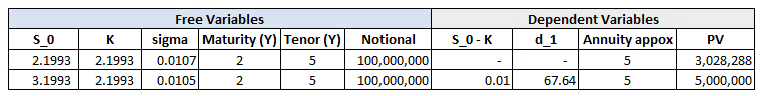

depends on discounting curve, but one can approximate it by tenor (![]() ) in years, i.e., no discounting. The swaption Bachelier’s/normal/Black’s vol is quoted in the unit of bps. For example, 107 means 107bps, i.e., 0.0107. Below we provide two examples of PV: one ATM and one ITM.

) in years, i.e., no discounting. The swaption Bachelier’s/normal/Black’s vol is quoted in the unit of bps. For example, 107 means 107bps, i.e., 0.0107. Below we provide two examples of PV: one ATM and one ITM.

For a receiver swaption, PV and greeks can be calculated in the same manner.