When our study group read John Hull’s Options, Futures, and Other Derivatives book section 4.10 Duration, there was a sentence that is not very intuitive: There is a negative relationship between bond yield and bond price. (When bond yields decrease, bond prices increase. When bond yields increase, bond price decrease.)

Intuitively, people would believe a high “yield” bond has high price. Here is an explanation to the anti-intuition fact.

Assumption

Suppose the coupon rate and time of payments of a bond are fixed. (It is fixed the time it is designed.) Namely, at time  , the bond holder will receive

, the bond holder will receive  dollars. The last payment

dollars. The last payment  contains the

contains the

notional/face value of the bond. At time  , maket has a quote

, maket has a quote  of this bond, i.e., how much people are willing to pay for this bond.

of this bond, i.e., how much people are willing to pay for this bond.

Formulation

Bond yield  is defined as the discount rate such that the sum of the present values of all payments is equal to the bond price

is defined as the discount rate such that the sum of the present values of all payments is equal to the bond price  . That is to say,

. That is to say,  is solved from the following equation:

is solved from the following equation:

![Rendered by QuickLaTeX.com \[B = \sum_{i=1}^n c_ie^{-yt_i}\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-5f47b218dc5d620d93b0ea28ef9bfc86_l3.png)

In the above equation, there are only two variables

and

. Hence,

is a function of

and vice versa.

![Rendered by QuickLaTeX.com \[B=B(y)\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-8525cffc6184c859c1dfcc2a925c6532_l3.png)

Then,

![Rendered by QuickLaTeX.com \[\mathrm{d}B = \frac{ \mathrm{d} B}{ \mathrm{d} y} \mathrm{d}y.\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-0cdd3841fe40e2a8d9be1f9cc65a4342_l3.png)

No partial derivatives because

and

are fixed. They are not variables.

Approximately, small change  in bond yield would result in the change of the bond price being approximately

in bond yield would result in the change of the bond price being approximately

![Rendered by QuickLaTeX.com \[\Delta B = \frac{ \mathrm{d} B}{ \mathrm{d} y} \Delta y.\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-4f162a0622f699054ba1be0becd81554_l3.png)

That is,

![Rendered by QuickLaTeX.com \[\Delta B = -\sum_{i=1}^n c_it_ie^{-yt_i} \Delta y.\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-ccc7ee64fba447b2ff1c04ee4888f2fc_l3.png)

Duration of a bond is defined to be the weighted average of the time of coupon payments and notional, where the weight is the present value. Namely,

![Rendered by QuickLaTeX.com \[D := \sum_{i=1}^n t_i\left[\frac{c_ie^{-yt_i}}{B}\right]\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-ecc44266db255d4cb94b8413e458aee2_l3.png)

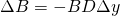

Plug this into the equation of

, we get

![Rendered by QuickLaTeX.com \[\Delta B = - BD \Delta y.\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-f76bf26b722f86fe809c035b4249c9ef_l3.png)

Explanation

Mathematically, if  is positive, then

is positive, then  is negative. If

is negative. If  is negative, then

is negative, then  is positive.

is positive.

Intuitively, bond yield and bond price are two ways to quote a bond; just like in describing fuel efficiency, you can use miles/gallon or liters/hundred miles. There is a one to one correspondence between bond yield and bond price. Higher bond yield is corresponding to a lower bond price. We can not say higher bond yield results in lower bond price.

The usual “yield” in people’s mind is actually coupon rate. Higher coupon rate definitely results in higher bond price (if other conditions keep the same).

The market usually quotes bond yield. People can get the approximated bond price change by the formula  .

.

What causes the change of a bond price?

Change of interest rate (risk-free rate).

If the interest rate rockets, then the present value of a payment in the future will worth less money. Then, th bond price, which is the sum of present values of all payments in the future, will decrease.

![]()

![]()

![Rendered by QuickLaTeX.com \[\begin{aligned} &~ \mathbb{E}[e^{-rT}(A_T-K)^+] \\= &~ \mathbb{E}[e^{-rT}(\frac{1}{T}\int_0^T S_u \textnormal{d} u -K)^+] \\\leq & ~ \mathbb{E}[e^{-rT}\frac{1}{T}\int_0^T (S_u-K)^+ \textnormal{d} u] \\= &~ \frac{1}{T}\int_0^T \mathbb{E}[e^{-rT} (S_u-K)^+ ] \textnormal{d} u \\\leq &~ \frac{1}{T}\int_0^T \mathbb{E}[e^{-ru} (S_u-K)^+ ] \textnormal{d} u \\\leq &~ \frac{1}{T}\int_0^T \mathbb{E}[e^{-rT} (S_T-K)^+ ] \textnormal{d} u \\ = &~ \mathbb{E}[e^{-rT} (S_T-K)^+ ] \\ \end{aligned}\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-5cf23b380e772edddabfc8ff197e5364_l3.png)

![Rendered by QuickLaTeX.com \[\begin{aligned}\mbox{Var}(\Delta S-h\Delta F) &= \mathbf{E}[(\Delta S-\overline{\Delta S}-h(\Delta F-\overline{\Delta F}))^2] \\&= \mathbf{E}[(\Delta S-\overline{\Delta S})^2] + h^2\mathbf{E}[(\Delta F-\overline{\Delta F})^2] \\ & \quad - 2h\mathbf{E}[(\Delta S-\overline{\Delta S})(\Delta F-\overline{\Delta F})] \\&= \sigma_{\Delta S}^2+ h^2\sigma_{\Delta F}^2 - 2h~\mbox{cov}(\Delta S,\Delta F) ,\end{aligned}\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-de2ed3dccaefcf8f4df0dcd0915dd7ad_l3.png)

![Rendered by QuickLaTeX.com \[B = \sum_{i=1}^n c_ie^{-yt_i}\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-5f47b218dc5d620d93b0ea28ef9bfc86_l3.png)

![Rendered by QuickLaTeX.com \[\Delta B = -\sum_{i=1}^n c_it_ie^{-yt_i} \Delta y.\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-ccc7ee64fba447b2ff1c04ee4888f2fc_l3.png)

![Rendered by QuickLaTeX.com \[D := \sum_{i=1}^n t_i\left[\frac{c_ie^{-yt_i}}{B}\right]\]](https://sisitang0.com/wp-content/ql-cache/quicklatex.com-ecc44266db255d4cb94b8413e458aee2_l3.png)